Bitcoin surges on interest rate cut expectations, cryptocurrency market rebounds

As the market anticipates the Federal Reserve's imminent announcement of a rate cut to boost the economy and The simplest trading method for foreign exchange hedgingstimulate demand for speculative assets, the cryptocurrency market is experiencing a noticeable surge. Bitcoin once rose by 6%, reaching its highest point in over a month, while other cryptocurrencies like Ethereum and Solana also followed suit. The market widely believes that there is a high likelihood of a Fed rate cut this time, especially as expectations for a 50 basis point cut bolster market optimism.

Shi Liang Tang, President of Arbelos Markets, stated that the increasing correlation between cryptocurrencies and traditional financial markets is one of the key driving factors behind the rise in assets such as Bitcoin. Additionally, MicroStrategy's recent announcement of increasing its Bitcoin holdings has further boosted investor confidence.

Despite Bitcoin's recent strong performance, market volatility remains significant. Future trends will depend on the Federal Reserve's policy direction and market reactions. As an emerging asset class, cryptocurrencies are playing an increasingly important role in the context of global monetary policy changes.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

相关推荐

- ASIC reveals AustralianSuper pension account scandal

- Gold fluctuates amidst the tug

- Disagreements within the EU are hindering the progress of US

- In May, Japan's real wages encountered the largest decline in nearly two years.

- Market Insights: Jan 17th, 2024

- Manufacturing activity in Japan expanded for the first time in 13 months in June.

- S.Korea's June manufacturing contracts 5th month, decline eases as domestic outlook improves

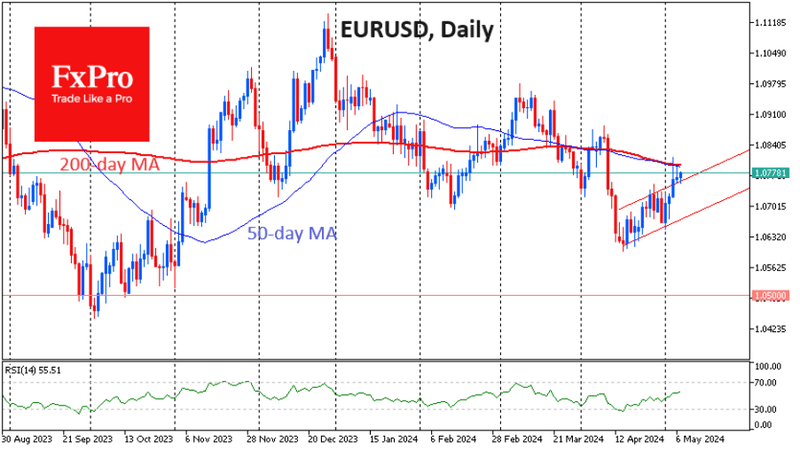

- Euro at turning point as Germany's CPI hits 2% ECB target,Lagarde warns of inflation volatility

Fxscam News

Fxscam News